The Rotary Foundation (TRF) and its many programmes are supported through contributions from Rotary clubs and individual Rotarians.

The Rotary Foundation (TRF) and its many programmes are supported through contributions from Rotary clubs and individual Rotarians. Under the ‘Every Rotarian, Every Year’ programme Rotarians are encouraged to give something to the Foundation, and contributions are recognised as follows:

- Rotary Foundation Sustaining Member: a commitment to give US$100 annually

- Centurion: a commitment to give NZ $100 annually

- Paul Harris Fellow (PHF): accumulated contribution of US$1,000

- Multiple PHF – for each cumulative US$1,000

- Paul Harris Society: a commitment to give US$1000 annually

- Major Donor – accumulated giving reaches US$10,000 (level one – further recognition is given at higher levels)

- Contributions to the Annual Fund, Polio, the Permanent Fund and some other approved grant activities are all eligible for recognition

Rotarians can also make contributions to the Permanent Fund in their will. Those pledging US$1,000 will be recognised as a benefactor and those pledging US$10,000 will be recognised as a Bequest Society member.

When either a club or an individual has contributed US$1,000 to TRF, a Paul Harris Fellow may be designated. Many clubs present Paul Harris Fellows to a worthy Rotarian or other member of their community who embodies the Rotary ideal of “Service above Self”. Individuals may use the Paul Harris Fellow as a way of recognising important events such as anniversaries or births as well as celebrating their own significant contribution to the Foundation. Throughout the world over one million people proudly wear the PHF pin to celebrate the work of the Rotary Foundation.HOW TO GIVE

When either a club or an individual has contributed US$1,000 to TRF, a Paul Harris Fellow may be designated. Many clubs present Paul Harris Fellows to a worthy Rotarian or other member of their community who embodies the Rotary ideal of “Service above Self”. Individuals may use the Paul Harris Fellow as a way of recognising important events such as anniversaries or births as well as celebrating their own significant contribution to the Foundation. Throughout the world over one million people proudly wear the PHF pin to celebrate the work of the Rotary Foundation.HOW TO GIVEThe District has created a brochure which describes all of the above ways individuals can support The Rotary Foundation. This brochure is a great tool for clubs to promote The Rotary Foundation among its membership. Click on this image, or go to TRF Forms and Downloads to open this brochure.

Club Contributions

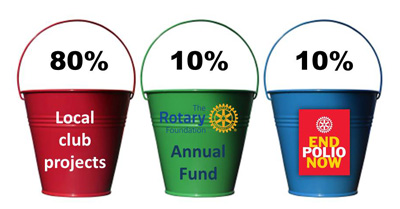

District 9930 asks that clubs consider giving 10% of their fundraising each year to the Annual Fund and 10% to Polio. For club giving, the Club Treasurer should use the Multiple Donor form, using just the first line in the table for listing contributors. If individual members are also making personal contributions they can be listed below that. For each contribution, the programme the funds should be allocated to should be indicated, and in the case of individual contributions the Centurion column should be ticked if the Rotarian wants to be recognised in this way. Contributions can be deposited to the District Foundation Account 03 1552 0121120 001, with club name and program included in the reference. The Multi Donor Form can be emailed to the Administrator – rotaryfoundation9930@gmail.com

Individual Contributions

Individual contributions are identified separately from club contributions. The goal for individual contributions is “Every Member, Every Year”, that is, we want every individual Rotarian to commit to personally supporting the Rotary Foundation every year. Individual contributions can be processed by any of the following means.

-

Individual Rotarians can give their contributions to the Club to submit using the Multiple Donor Form (as described above). The club must list the Rotarian on the form to ensure they get recognition.

-

Individual Rotarians can submit contributions using the Individual Donor form and either send the form with a cheque to the District Foundation Administrator, or make the deposit via a direct deposit and email or post the form.

-

Individual Rotarians can make regular automatic payments through their bank by completing an Automatic Payment order which notifies the bank of the desired amount and schedule of the automatic payments.

It is important that all club and individual contributions are supported by a completed form submitted to the District Foundation Administrator so that payments can be properly credited to the donor.

All payments and forms should be sent to the District Foundation Administrator:

District Foundation Administrator – rotaryfoundation9930@gmail.com Ross Pinkham (Greenmeadows) 027 2428089

All club and individual contributions should be made to bank account: 03 1552 0121120 01 with the club or Rotarians name as reference.

Please DO NOT SEND contributions to Rotary International in Parramatta, or to the District Treasurer, or to Guardian Trust, as has been done in the past as this may cause delays and errors in attributing payments to the right donors.

Tax Deductions: Most clubs now have a Charitable Trust registered with the Charities Commission. The purpose of this trust is to accumulate income which is not liable for New Zealand income tax. Contributions to your club’s charitable trust from your incorporated society may be tax deductible by the club. Donations from an individual to the trust should qualify for a donation rebate.

Legally, income from your club’s charitable trust may only be distributed to a New Zealand charitable entity. For this reason, New Zealand’s Rotary Districts have established a separate body, the Rotary NZ Charitable Trust (RNZCT), managed by Guardian Trust. New Zealand legislation allows RNZCT to distribute income outside the country. Therefore, to stay within the bounds of your trust deed and the New Zealand tax laws, contributions to TRF should be sent to the District Foundation Administrator who will. DO NOT send payments directly to Guardian Trust.